Insights That Lead

The LRS Blog

Your go-to source for expert retirement strategies, industry updates, and financial empowerment.

Client & Partner Spotlights

February 16, 2026

Client Spotlight: Housing Works

Read more to see how Housing Works is strengthening support for the employees who make their mission possible.

January 12, 2025

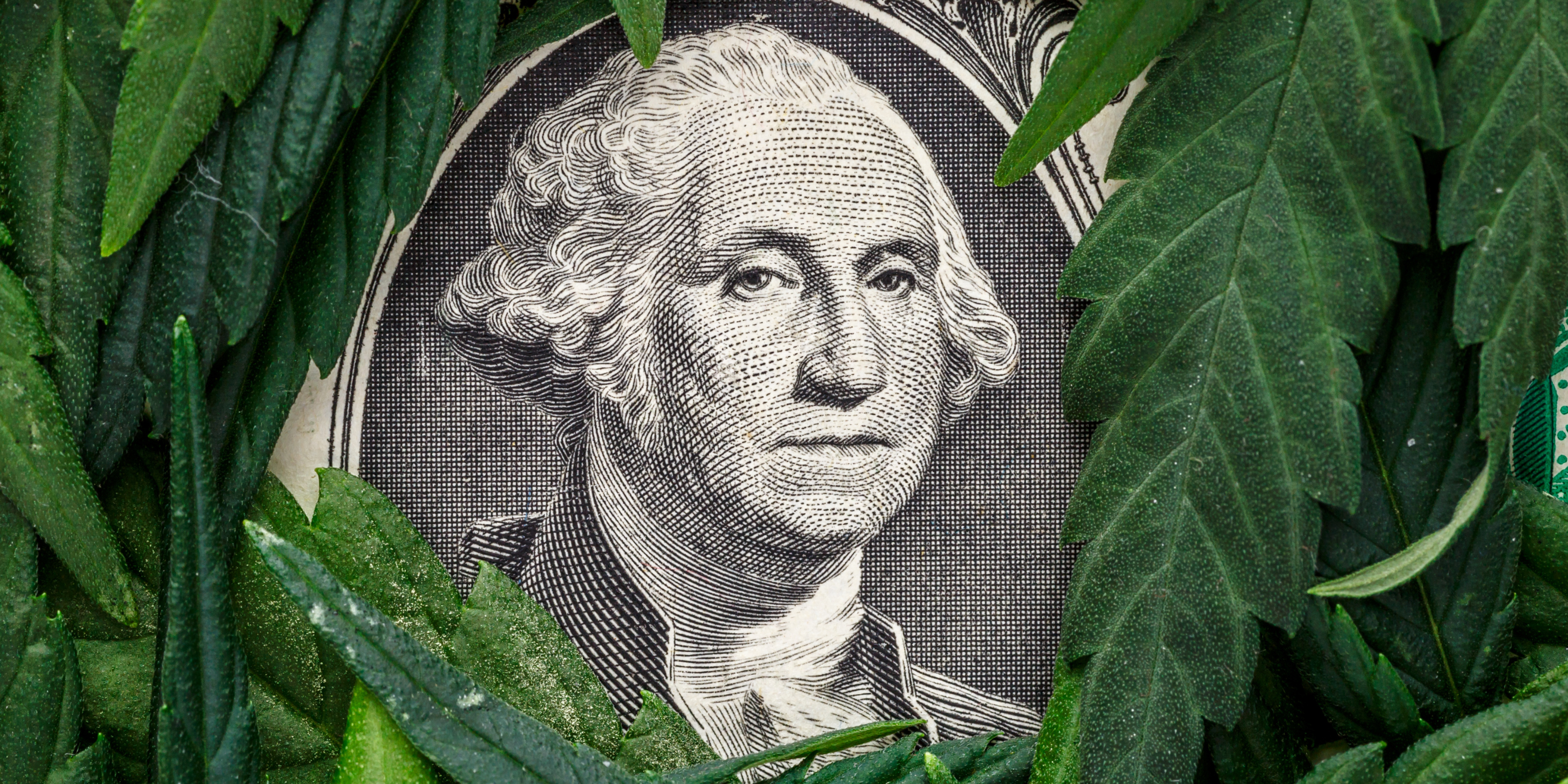

Client Spotlight: Embarc

See how Embarc and LRS deliver a compliant cannabis 401(k) that streamlines HR, strengthens employee engagement, and elevates industry standards.

December 29, 2025

Client Spotlight: STIIIZY

Read more about how STIIIZY teamed up with LRS to bring future-focused retirement benefits to its employees.

Client & Partner Spotlights

February 12, 2026

Client Spotlight: Housing Works

Read more to see how Housing Works is strengthening support for the employees who make their mission possible.

January 12, 2025

Client Spotlight: Embarc

See how Embarc and LRS deliver a compliant cannabis 401(k) that streamlines HR, strengthens employee engagement, and elevates industry standards.

December 29, 2025

Client Spotlight: STIIIZY

Read more about how STIIIZY teamed up with LRS to bring future-focused retirement benefits to its employees.

Client & Partner Spotlights

February 12, 2026

Client Spotlight: Housing Works

Read more to see how Housing Works is strengthening support for the employees who make their mission possible.

January 12, 2025

Client Spotlight: Embarc

See how Embarc and LRS deliver a compliant cannabis 401(k) that streamlines HR, strengthens employee engagement, and elevates industry standards.

December 29, 2025

Client Spotlight: STIIIZY

Read more about how STIIIZY teamed up with LRS to bring future-focused retirement benefits to its employees.