Third Party Administrator (TPA)

A Third-Party Administrator (TPA) to a retirement plan is an outside organization that is hired by a company sponsoring a retirement plan (e.g. 401(k), 403(b), etc.) to complete the various requirements applicable to the IRS and Department of Labor. TPAs handle various compliance requirements including: plan design, discrimination testing, financial reporting, government reporting, consulting, correction services and even plan termination, among others. Hiring a TPA is common among business owners as it frees up much needed time and effort that is then used to focus on building a successful enterprise.

Why should a financial advisor partner with a TPA in the first place when they could simply take on the administration of the retirement plan themselves? Well, in a way it’s kind of like asking a cardiovascular surgeon to perform brain surgery. Both are extremely complex and skilled professions, but besides existing in the same industry the knowledge within these specialties is unique to its own area of expertise, and the same is true for retirement plan management.

Unless you want to dive into the extremely complex and evolving world of regulations governing retirement plans, as a financial advisor your time is much better spent helping your clients reduce their tax burden, save more for retirement, diversify their investments and seek out new opportunities for increasing their wealth. Besides, TPAs are also a great source for referrals and overall a good ally to have around.

How do you know which TPA to choose?

This question is only answered by understanding the personal and business goals and priorities of your clients. Simply, can the TPA you are considering help you and your client attain their goals and priorities? Let me explain.

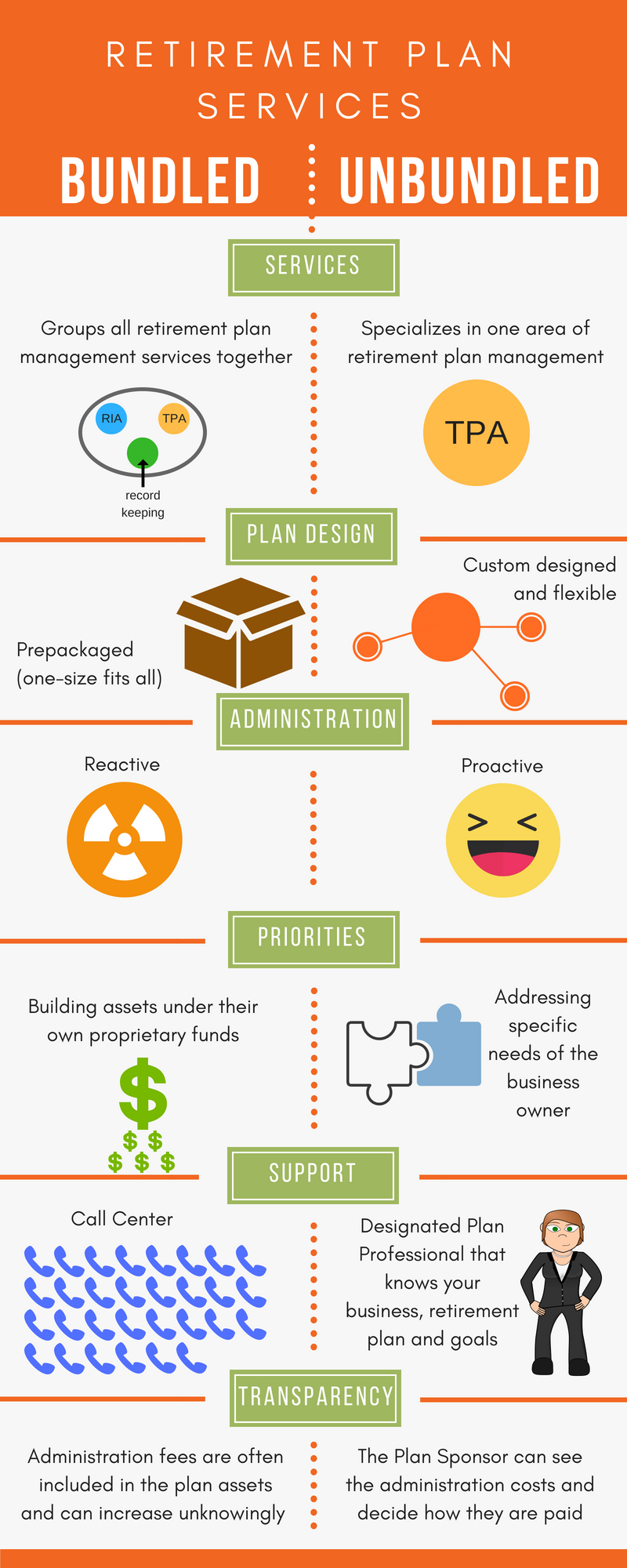

There are generally two types of TPAs in the retirement plan space based on how they provide their services: bundled or unbundled (also referred to as independent). In a nutshell, your client has a choice between a retirement plan “product,” which are basically prepackaged solutions bundled with recordkeeping and financial advising, or an unbundled service that offers customized retirement plan solutions specifically designed to meet individual business’ needs and accomplish future goals. But let’s dive into this a little further.

Bundled Service Providers

These service providers are generally larger, more well-known financial firms whose primary service is managing assets on their investment platform and/or in their proprietary funds/investment contracts. To fulfill the trifecta of retirement plan management these companies will also offer Third-Party Administration services to round themselves out as a one-stop shop for everything related to retirement plans, and subsequently pull more assets onto their platform.

For an unknowing business owner this may appear to be an easier and possibly better solution, as they can avoid shopping around for an independent, reputable TPA to fulfill all three required areas of retirement plan management: Administration, Recordkeeping and Investment Advice. Even for financial advisors, a bundled service provider may appear appealing at first, however, there are a number of shortcomings often experienced by advisors and their clients with a bundled service provider. We will get into those, shortly.

Unbundled Service Provider

These service providers, as you probably already guessed, specialize in one area of retirement plan management and, therefore, operate separately from the other two. For example, independent financial/investment advisors are highly regarded for being experts in their field, most do not offer administration or recordkeeping services but rather practice and exercise an incredible depth of knowledge in investments, along with building wealth and savings. In the same regards, an unbundled TPA, such as Leading Retirement Solutions, specializes in creating retirement plans and building the right set of services to address specific goals and needs of the business and business owner while maximizing benefits and reducing tax burdens and liabilities.

These TPAs are also more proactive with their clients’ plans due to the unique nature of the plan design and the inherent flexibility built into the plans making them adaptable to the business as it grows or changes strategy. For example, if the priority of a business is to attract and retain talent, then the (unbundled) TPA will design a plan that will engage in strategies to achieve these goals, whereas later the business priorities may shift, and the goal may then reflect a business growth strategy. A plan designed by an unbundled TPA service provider can easily adapt to changing business strategies, unlike bundled service providers, which usually only offer prepackaged solutions that won’t necessarily work for individual business owner’s needs now or in the future.

See how to discover new prospects in women-owned business for financial advisors

Understanding Priorities

As mentioned earlier, the right TPA for your client will come down to aligning priorities. The priorities for a bundled service provider is pretty straight forward: they attempt to bring as much money onto their platform or into their proprietary funds as possible while reducing their own costs. Their market strategy to fulfill this priority and which also initially attracts customers boils down to two things: cost-leadership and convenience. However, this initial attraction of cheap and easy usually ends up resulting in frustration and financial anguish for business owners over the long run. But let’s break this down further.

The cost-leadership strategy for bundled service providers is their ability to offer competitive pricing by reducing their own cost of doing business. And who doesn’t like a bargain? However, as the saying goes, “you get what you pay for.” Bundled service providers reduce their own costs by prepackaging their services which result in unsophisticated plans with limited options for business owners, while relying heavily on automation and call centers to improve operational efficiencies.

Furthermore, bundled service providers create this idea of convenience by, you guessed it, bundling retirement plan management altogether in a one-stop shop. Sure, it’s convenient but does that mean they are actually good at all three aspects of retirement plan management? Does your dentist also do orthodontics and oral surgery? Most likely no. Just because they may excel in something like payroll, doesn’t mean they’re very good at financial advising or administration.

Moreover, a bundled service provider focused on building assets under their own funds puts compliance to government regulations much further down on their list of priorities, resulting in a reactionary approach to compliance issues rather than a proactive one. And any issue in compliance is the single most expensive component to an employee benefit plan, which the plan sponsor is ultimately responsible for even if their TPA messed up.

With unbundled TPA service providers their priorities are directly tied to compliance. Because retirement plans created by these TPAs require more insight into strategy to specifically accomplish certain business goals, the TPA is constantly engaged with the plan and its compliance throughout the year. In fact, these TPAs overall are more engaged with their clients because their main job is protecting the business and the owners from compliance issues, limiting their liability, reducing their tax burden, and advising on varying strategies, while helping them provide retirement savings tools for their workforce.

With unbundled service providers you will have a designated professional who knows your business, strategies, goals, and plan design; with a bundled service provider you will get a call center, good luck.

So, what are your clients’ priorities regarding their businesses and goals? Are they looking for a specific strategy or are they planning on growing their business in the next few years? We both know the answer, yes.

Below is an infographic for your convenience comparing bundled and unbundled services.

_________________________________________________________________

For more tips and information regarding retirement plans, follow our blog.

Connect with us on Facebook, LinkedIn, and Twitter!